The Fight Against Online Fraud: Prevention Tools and Merchant Preparedness

July 31, 2021

An increased dependence on online shopping cultivated exponential growth in digital commerce during the COVID-pandemic. However, these new opportunities often give way to new schemers: more sophisticated fraud strategies aim to exploit merchant vulnerabilities online. Fortunately, there are effective tools available for combat against threats.

Growing eCommerce and Merchant Fraud Prevention

The pandemic single-handedly accelerated the shift towards digital commerce, with 2020 seeing a record high of 21.3% in eCommerce. Paypal’s active user base grew 15.38% from 325 million to 375 million between spring 2020 and spring 2021.

These shifts present great opportunities for merchants, who have new doors open to revenue potential:

This [active customer growth] is not just consumers… it’s also merchants who have had to really focus on the omnichannel shopping experience

- Arthi Rajan, VP of Global Fraud Risk, PayPal

The tidal wave of digital customers is an added challenge to fraud prevention for merchants. According to Raymond Pucci, Director of Merchant Services at Mercator Advisory Group, “E-commerce draws a crowd of fraudsters and many merchants that may not have been used to the online sales channel and what it brings with it—the fraud—were unprepared. And I think their eyes were opened [to the fact] that they really need to undertake a dynamic fraud strategy.”

Rajan further delves into the topic of the tie between digital commerce and fraud using a castle analogy: in an attempt to protect the crown jewels, a stone wall is built around a castle. This does little to deter thieves from simply building bigger ladders. In the same token, fraudsters will continue to evolve in response to digital commerce changes.

“As you continue to build the walls of your castle higher, those fraudsters bring taller ladders to get over the hump. And this is just the nature of the ecosystem that we live in,” she explained.

The Real Cost of Digital Fraud

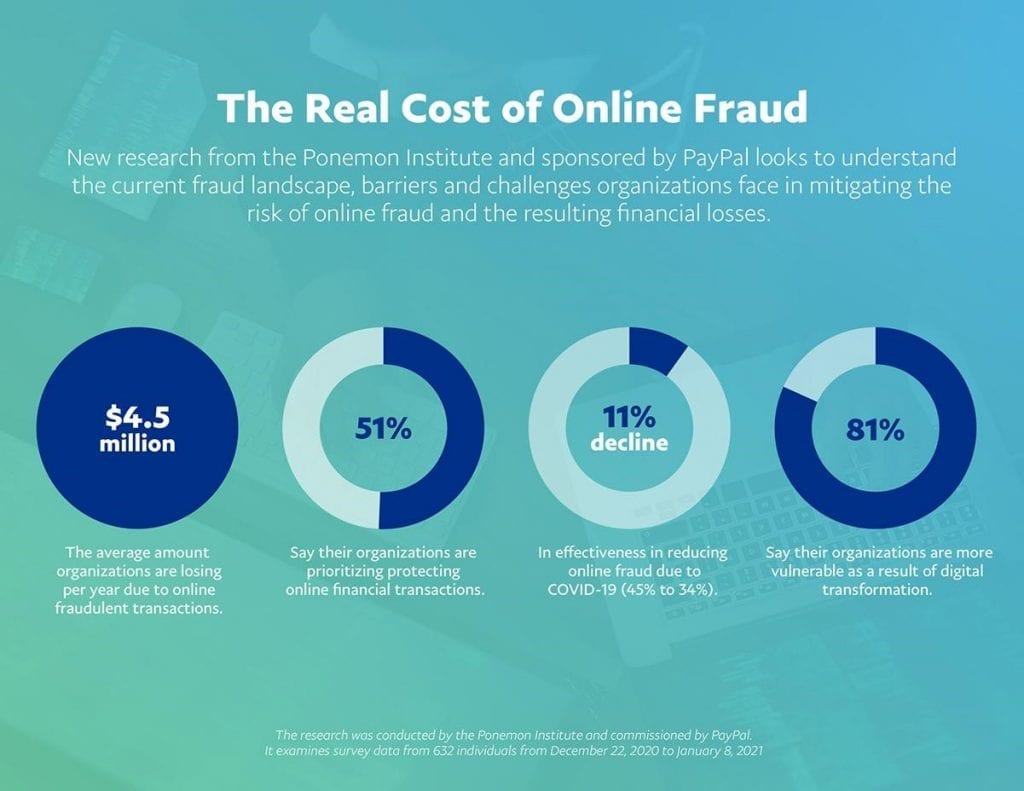

In an effort to understand the online fraud landscape, Paypal funded the Ponemon Institute’s report “The Real Cost of Fraud” in which more than 600 analysts and senior leaders were canvassed about their organization’ fraud prevention capabilities. The infographic details key findings from the study:

Of 632 respondents, 512 (81%) reported obvious vulnerabilities in their organization as a result of “rapid digital transformation.”

When you embark on a voluntary digital transformation, you have had the time to think through not just the transformation itself, but all the areas that you need to transform along with it, like authentication, fraud, and so on. But, when you are thrust into this event that sort of accelerates that transformation, you really don’t have the time to think through and implement a lot of [these] things.

- Rahul Pangam, VP of Risk Strategy at Paypal

Prior to the pandemic, 45% of organization leaders thought highly of their fraud prevention tools compared to only 34% of respondents today, a precipitous 11% decline. Just over half of respondents also reported that fraud prevention was not seen as a top priority in their organization. “This tells me that, because of the disruptive change, [organizations] had to juggle a lot of balls at one point in time and being able to prioritize and dedicate to each individual area is almost impossible,” explained Pangam.

Raymond Pucci agrees, stating that Ponemon’s findings lays to bare the vulnerability among merchants: “The true cost of fraud for merchants is not only the merchandise or the value of the service, but also the labor and overhead resources that go into fulfilling an online order and then realizing there’s fraud attached to that.”

Curbing Fraud Starts with Cooperation

Paypal soon noticed that their most successful fraud teams often had collaborative relationships between internal fraud and cybersecurity teams working alongside an external partner equipped with effective fraud tools. Potential partners need the industry expertise more to find suitable, long-term solutions. To combat rising fraud, Paypal introduced a suite of fraud solution product geared to enterprise merchants: Fraud Protection Advanced. Taking more than twenty years of development, the tool use billions of data points from Paypal’s two-sided network of both merchants and consumers (accounting for 15 billion annual transactions).

The tool builds upon Paypal’s existing Fraud Protection risk management solution, targeting mid-size and large merchants.

“What we heard from our mid-market and large enterprise merchants is they wanted a more advanced flavor of our fraud protection capabilities for self-service… We took that feedback and we built an advanced version of Fraud Protection,” said Pang.

Merchants who were already processing with Braintree, a Paypal subsidiary, can access Fraud Prevention Advanced almost immediately (unlike the several weeks to months wait for new solution implementation).

What We’ve Gathered

Skyrocketing online commerce amid the COVID-19 pandemic has offered valuable revenue streams for digitally present merchants. However, the looming threat of fraud remains ever present as vulnerabilities are exploited. Now, more than ever, online security is imperative.

By partnering with organizations like Paypal, merchants have a suite of effective tools at ready to combat sophisticated fraud schemes, protecting both themselves and their customer.

“Fraud fighting is really a team sport. It takes every part of your organization, and it takes an ecosystem partnership to really keep that overall e-commerce environment safe and one where customers can shop with confidence and merchants can focus on growing their businesses,” concluded Rajan.

How Alto Global Processing Can Help

Alto Global Processing also operates a subsidiary fraud management system: Altoshield.com. We mitigate fraud threats AltoShield Prevention System is a real-time communication system meant to protect merchant revenue from chargebacks and fraudulent activity. Reach out to us for your business needs as we navigate the expanding digital landscape together.

Want to learn more? Check out the full write-up here.

Share your thoughts on our LinkedIn page.